A few disconnected situations floated by me this week, and of course That Planning Guy has to make the connections. Nothing is truly random. (Old Dilbert joke about an accounting Troll, generating random #’s… he is yelling 7,7,7,7,7,7,7.. Dilbert asks “Is that random? How can we really know?”)

First, someone commented about how strong the demand was for advanced Planning and Assortment tools in the marketplace today. Very true: I have preached for years, it all starts with great planning. Planning drives assortment. Assortment drives replenishment. Replenishment removes stock outages. Throw in good product, of course – and the right product, at the right time, in the right amounts makes money. The consolidation in software makes everything both very specialized and homogenized. Hard to differentiate one great tool from the next, without a DEEP understanding of what the tool brings. Feature-Advantage-Benefit. “How does THAT help me” is the question I often ask.

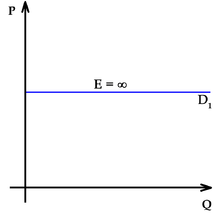

Next, someone else commented about a price of water on their vacation being MUCH lower than they could have (a large bottle of premium-brand water for $4.50 in Cayman?? That’s just crazy talk. Piled of money laying on the floor.) Clearly whoever determines that price is not listening to the demand signals, and pricing based on a perceived IMU goal. If the water was $4.95, would the guest even NOTICE, let alone care? No, and we all know that is true. But your P&L would certainly notice the 10% profit flow-through boost.

Last, a guest service ‘situation’ came up, and I don’t often get to be involved. A group of College students are coming to town to attend a large Apparel show, as they are in a merchandising-related major. I spoke to the students last year who came, and I had a really good time. This year, they moved from a competitor’s hotel to one of ours and I helped them arrange it. They made some # kids to room changes to be able to afford the new luxury hotel, and I appreciated that they preferred to stay in ‘our house.’ Long story, there was some mix up in the reservations, and they needed an accommodation added to the rooms that was not normally included, and reached out to me to see if I could help. They were literally at the peak of their budget already by staying in a great resort. So I reached out to a partner at the property, and he reached out to one of his partners, and within a day, we had resolved this issue. It cost the company ZERO to solve this problem. What did we gain? This group will now stay here every year, hopefully forever. The rooms and resort are beautiful, so 30 people per year, 10 years, that’s 300 new loyal customers. AND— since College kids, I would assume they are all Social-Media fiends, as my college-age daughter is, so likely have 1000’s of connections. This simple act may have changed the perception of tens of thousands of customers over time.

So where is the correlation? Listening to the customer, and not just superficially. What are they saying, but what are they SAYING. Spend patterns, buy patterns, hotel reviews, restaurant surveys, Yelp, FB and Insta, survey monkey, and simply asking the question – all these tell a story if you are reading it correctly. BIG picture, connect the dots.

And to react to it properly, you need to not just hear it, but understand it, internalize it, draw insights, and react to it – all in near-real time.

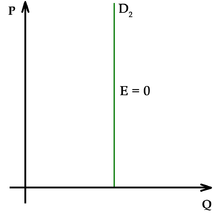

Right product+ Right time+ Right amount+ Right price = Right Profits. Any of these fail, and the chain is broken.

#AnalyticsDrivesBusiness.

Aloha Friday, fellow #datanerds

-That Planning Guy

You must be logged in to post a comment.